-

ETF Market Surge Today: Money Flows Investors Must Watch

•

Introduction The ETF market surge today offers investors a unique lens into capital allocation trends, risk sentiment, and potential market direction. Exchange-traded funds (ETFs) have evolved into one of the most popular investment vehicles worldwide, providing diversified exposure to equities, bonds, commodities, and alternative strategies in a single, liquid instrument. As of 2025, ETF…

-

S&P 500 Today Rockets: Key Market Moves to Watch Now

•

Introduction Today, the S&P 500 rockets as investors react to a mix of earnings reports, economic data, and sector-specific news, creating heightened volatility across the index. Understanding intraday movements and technical signals is essential for traders, investors, and market analysts who want to navigate today’s fast-moving environment successfully. The S&P 500, representing 500 of…

-

DroneShield DRO Today Unexpected Insider Moves Rattle Market

•

Introduction Today, DroneShield DRO shocked investors as unexpected insider moves rattle the ASX, driving heightened trading volume and rapid price swings. For shareholders, traders, and market watchers, understanding the dynamics behind DroneShield’s action is essential. Such insider activity often signals shifts in sentiment and can foreshadow short-term volatility, which is why today’s trading pulse…

-

ASX Plunge Today: What Investors Must Know Now

•

Introduction ASX Plunge Today has rattled the Australian stock market, leaving investors and traders analyzing causes and market implications. The ASX 200 fell nearly 2 %, erasing billions in value as global and domestic factors combined to trigger a broad sell-off (news.com.au). With uncertainty mounting, market participants are asking: What drove this sudden decline? Which…

-

The Truth About ASX 200 Financials:Banks, Insurance & Market

•

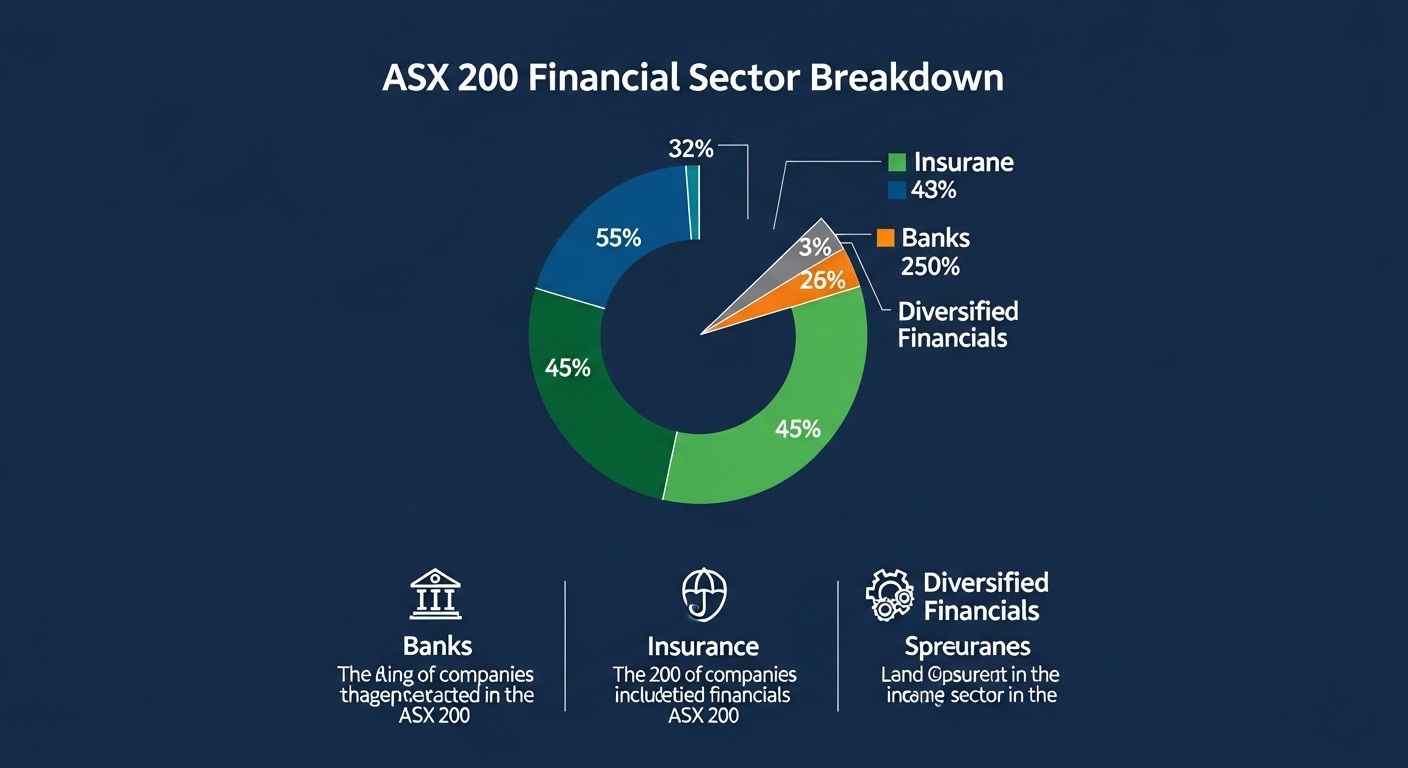

Introduction The ASX 200 financials sector is one of the most critical and influential components of the Australian stock market. Banks, insurance companies, and diversified financial firms together form the backbone of the index, accounting for nearly 35–40% of its total market capitalization. Because of this weight, movements in these companies significantly impact the…