Introduction

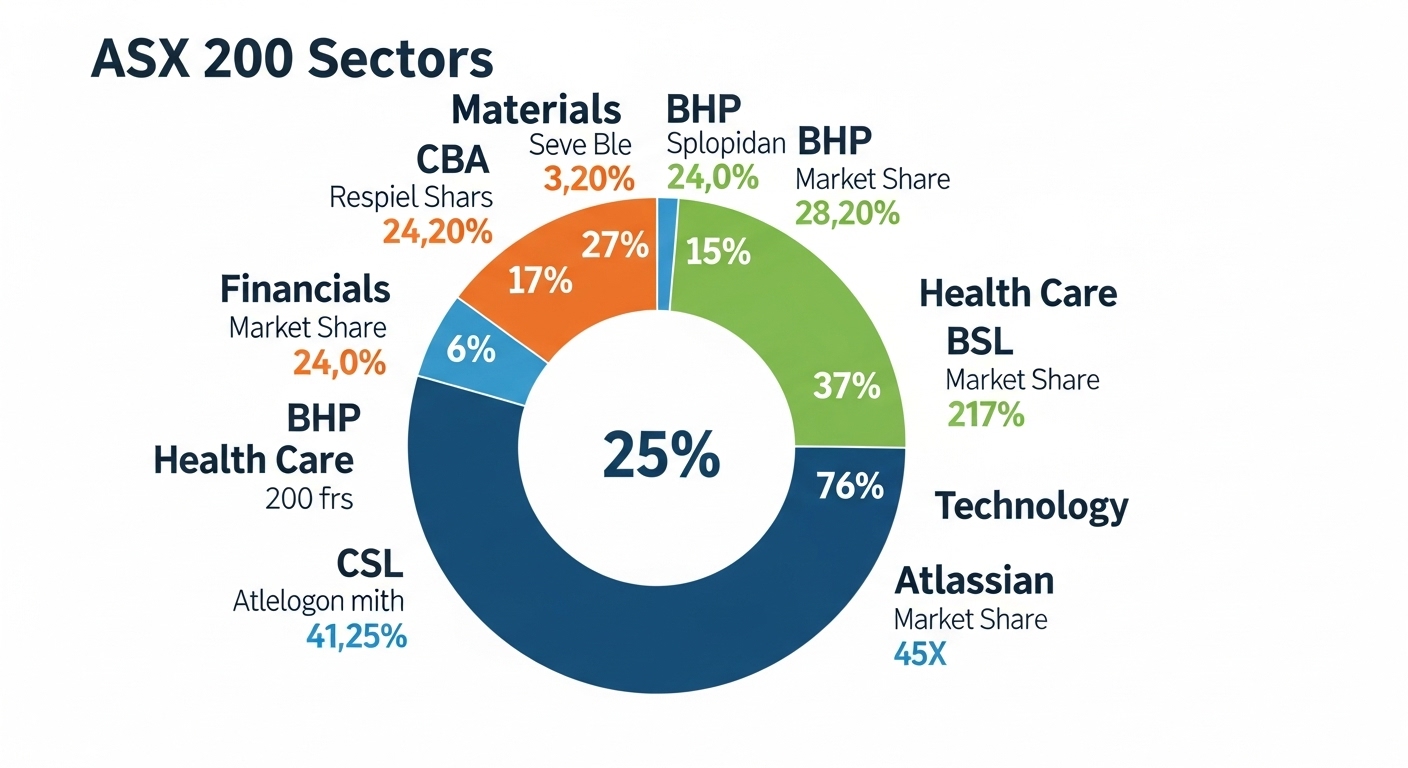

The ASX 200 sectors are essential for understanding the composition and performance of Australia’s top 200 listed companies. Each sector represents a unique slice of the economy, from banks and miners to healthcare providers and consumer staples. Understanding these sectors is vital for investors seeking diversification, risk management, and growth opportunities.

From my experience analyzing the ASX, I have seen that sector performance often reflects broader economic trends. For example, financials and materials are highly sensitive to interest rates and global commodity prices, whereas healthcare and utilities tend to remain stable during market volatility. By studying sector behavior, investors can anticipate trends, identify opportunities, and make informed portfolio decisions.

The ASX 200 is divided into key sectors: financials, materials, healthcare, industrials, consumer discretionary, consumer staples, energy, real estate, and utilities. Each sector has unique drivers, risks, and investment potential. Some sectors are cyclical, rising and falling with the economy, while others are defensive, offering stability when markets are turbulent.

In this blog, I will break down the ASX 200 sectors, highlighting their characteristics, how they interact with economic cycles, and strategies for investing in each. By understanding sector dynamics, you can make more strategic investment decisions and build a portfolio that balances growth, income, and stability. My goal is to provide a clear, actionable overview that equips both new and experienced investors with insights into Australia’s top-performing sectors.

Financials Sector in ASX 200 Sectors

The financials sector is the largest component of the ASX 200 sectors, including banks, insurers, and other financial institutions. Major players such as Commonwealth Bank, Westpac, and Macquarie Group dominate this segment. In my experience, financials are closely tied to macroeconomic conditions, interest rates, and credit demand.

Rising interest rates can benefit banks by expanding net interest margins, but excessive hikes or economic slowdowns can increase bad debts, affecting profitability. Insurance companies in this sector also face risks from natural disasters, regulatory changes, and claims trends. Investors monitor key indicators like GDP growth, unemployment rates, and central bank policies to gauge sector performance.

The financials sector is cyclical yet offers opportunities for growth and income. Banks and insurers often provide attractive dividends, making them appealing to income-focused investors. However, regulatory scrutiny and market sentiment can create volatility.

From a strategic standpoint, I often analyze financials for portfolio stability and growth potential. Large-cap banks and insurers usually have strong balance sheets, consistent earnings, and resilient market positions. Observing digital banking trends and fintech disruption also helps identify emerging opportunities within this sector. Understanding financials is crucial for investors looking to leverage the largest segment of the ASX 200 sectors effectively.

Materials Sector Overview in ASX 200 Sectors

The materials sector in the ASX 200 sectors consists of mining, metals, and resource companies, including BHP, Rio Tinto, and Fortescue Metals. This sector is highly cyclical and sensitive to global commodity prices, demand from key markets like China, and industrial growth trends.

Commodity price fluctuations significantly affect profitability. For example, iron ore, coal, and gold prices have historically shaped the earnings of Australia’s largest miners. Global infrastructure projects, geopolitical events, and trade policies can also impact sector performance. In my analysis, tracking these external factors is essential for anticipating materials sector trends.

Materials companies are capital-intensive and can experience high earnings volatility. However, they offer long-term growth potential during periods of rising commodity demand. Dividend payouts can vary depending on profits and capital expenditure requirements.

I often view the materials sector as a barometer of both the Australian economy and global industrial activity. When industrial demand is strong, companies in this sector outperform, providing growth opportunities. Conversely, during economic slowdowns, returns can be muted, highlighting the importance of timing, diversification, and strategic allocation. Understanding the materials sector is key for investors seeking exposure to Australia’s resource-driven growth within the ASX 200 sectors.

Healthcare and Consumer Sectors in ASX 200 Sectors

The healthcare sector in the ASX 200 sectors includes pharmaceutical, biotechnology, medical device, and healthcare service companies such as CSL, Cochlear, and ResMed. Healthcare is generally defensive, as demand for medical products and services remains stable even in downturns.

Growth in healthcare is driven by aging populations, increased spending, and innovation in biotechnology and medical technology. Regulatory approvals, research breakthroughs, and global expansion can create substantial upside potential. In my experience, combining stability with innovation makes healthcare a strategic sector for long-term investing.

The consumer sectors include discretionary and staples. Consumer discretionary companies—like Aristocrat Leisure and Harvey Norman—benefit from rising incomes and consumer confidence but are sensitive to economic cycles. Consumer staples—such as Woolworths and Coles—offer defensive stability, as demand for essential goods remains relatively constant regardless of market conditions.

Analyzing healthcare alongside consumer sectors allows investors to balance defensive and growth-oriented holdings. In my portfolio approach, I often use healthcare and staples as stabilizers during volatile periods, while discretionary provides growth exposure during economic expansions. Understanding these sectors within the ASX 200 sectors helps investors allocate capital strategically and navigate changing market conditions with confidence.

Industrials, Energy, and Utilities in ASX 200 Sectors

The industrials sector includes companies involved in transportation, logistics, construction, and manufacturing. Firms like Transurban and Qantas dominate this segment. Performance is closely linked to economic growth, infrastructure investment, and business activity.

The energy sector comprises oil, gas, and renewable energy companies, including Woodside Energy and Santos. Sector performance is highly cyclical, influenced by global energy prices, supply-demand dynamics, and geopolitical events. I often monitor commodity trends and policy developments to anticipate potential sector shifts.

Utilities, including electricity, gas, and water providers like APA Group and Origin Energy, are considered defensive. Stable demand for essential services generates consistent cash flow and dividends, offering portfolio stability during volatile markets.

Investors benefit from understanding the interplay between cyclical sectors (industrials, energy) and defensive sectors (utilities). From my experience, combining these sectors allows for balanced exposure to growth, income, and stability. Monitoring macroeconomic indicators, commodity trends, and regulatory changes is crucial for navigating these ASX 200 sectors effectively and aligning investments with market conditions.

Conclusion

The ASX 200 sectors provide a comprehensive view of Australia’s largest companies and their respective economic contributions. Each sector—financials, materials, healthcare, consumer, industrials, energy, and utilities—offers distinct investment opportunities, risks, and growth potential. From my experience, understanding these sectors is essential for building a diversified, resilient portfolio.

Cyclical sectors like financials, materials, industrials, and consumer discretionary tend to follow economic cycles, offering growth during expansions but facing challenges during downturns. Defensive sectors such as healthcare, consumer staples, and utilities provide stability, while energy and real estate can offer cyclical growth and income opportunities. Analyzing sector dynamics in the context of broader economic trends helps investors make informed decisions.

Knowledge of ASX 200 sectors enables better portfolio allocation, risk management, and trend anticipation. Combining sector insight with company-level analysis strengthens investment strategy and improves long-term outcomes. Breaking down the ASX 200 by sectors equips investors with a roadmap to navigate Australia’s equity market with confidence and clarity.

By understanding the unique characteristics of each sector, I have been able to make more strategic investment decisions, balancing growth, income, and stability across market conditions. Awareness of sector performance allows investors to capitalize on opportunities and protect against potential downturns, ultimately enhancing portfolio resilience.

Key Takeaways

- Cyclical sectors like financials, materials, and industrials follow economic trends and offer growth potential.

- Defensive sectors such as healthcare, consumer staples, and utilities provide stability during market volatility.

- Understanding ASX 200 sectors allows investors to diversify and align portfolios with market conditions.

Further Reading on Mastering ETFs

Understanding Tracking Error and Premiums in ETFs

Passive vs. Active ETFs: Which One Wins Long-Term?

How Dividends Work in ETFs: Total Return Secrets

Index Funds vs. Individual Stocks: The S&P 500 Way

The Basics of Diversification: Why You Need More Than One Stock

Dividends: Income from the S&P 500

For a broader understanding of investment strategies, you can also explore Mastering ETFs for sector-focused ETF insights and Today | Trading Pulse for daily S&P 500 updates. Combined with historical performance and sector analysis, tracking the top 10 companies equips investors with the tools to navigate U.S. equity markets confidently